Markets Sink as Weak TCS Earnings and Trump Tariffs Rattle Investor Confidence

Indian equity benchmarks closed sharply lower on Thursday, July 11, as weak Q1 earnings from IT giant TCS and renewed global trade tensions triggered broad-based selling across sectors.

The BSE Sensex opened at 82,820.76, down from its previous close of 83,190.28, and plunged 748 points to an intraday low of 82,442.25. It eventually ended the session 690 points, or 0.83 per cent, lower at 82,500.47. Meanwhile, the NSE Nifty 50 fell 205 points, or 0.81 per cent, to settle at 25,149.85 after slipping to a low of 25,129 during the day.

The market downturn was largely driven by disappointing earnings from Tata Consultancy Services (TCS), which reported its weakest Q1 performance in five years. For the quarter ended June 2025, TCS posted revenue of $7.42 billion — a decline of 0.59 per cent from the previous quarter and 1.12 per cent year-on-year. The results fell short of Bloomberg analyst estimates, which had forecast revenue of $7.54 billion. This marks the company’s third consecutive quarter of falling revenue, sparking concerns about the broader outlook for India’s export-driven IT sector.

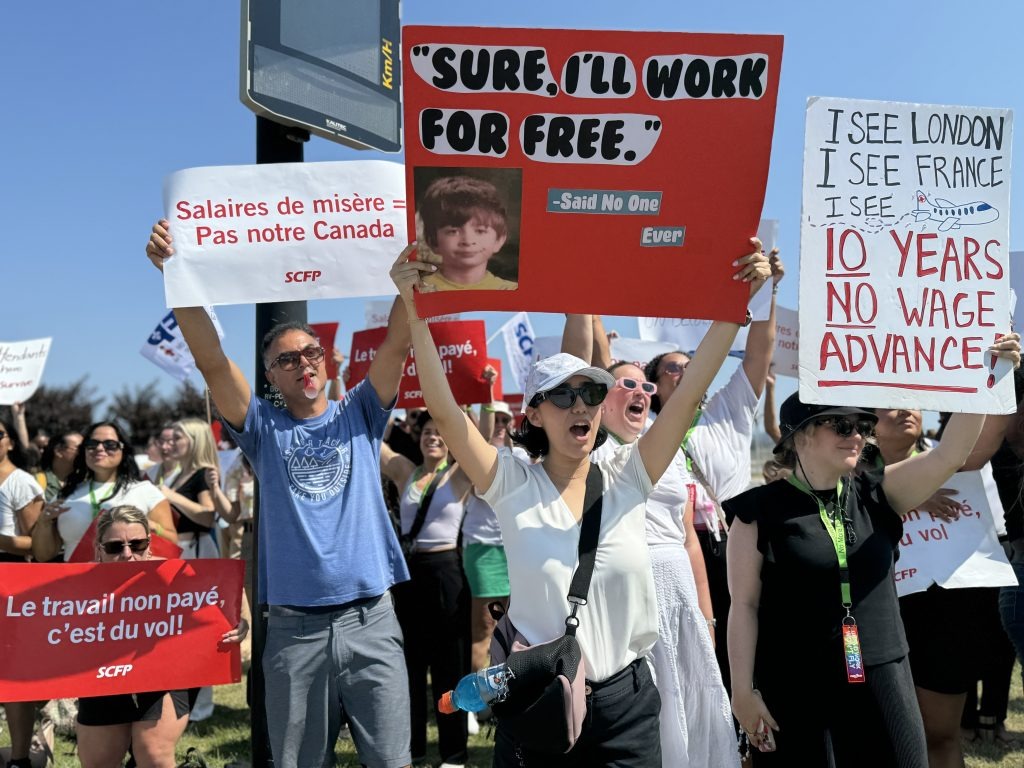

Investor sentiment was further dampened by renewed global trade tensions. U.S. President Donald Trump announced a 35 per cent tariff on goods imported from Canada starting August 1, while also indicating that baseline tariffs for other countries could rise to 15–20 per cent. These aggressive trade moves dashed hopes of a near-term resolution to the ongoing trade war and raised fears of a global economic slowdown.

The combination of weak domestic earnings and external macroeconomic headwinds triggered heavy selling in IT, auto, oil & gas, and consumer durables. Market participants also remained cautious amid rising crude oil prices and concerns over capital outflows.

With more Q1 earnings lined up and geopolitical uncertainty rising, analysts expect near-term volatility to persist. Investors are likely to stay defensive and closely track both corporate earnings and global policy developments for direction.